Ch 23 - Finance Saving and Investment

Friday, April 06, 2012

6:51 PM

- Saving

- Capital gains (increase in value of owned assets)

- Generally go out of business

- More serious than illiquidity

- Have positive new worth, but can't generate funds to pay current expense

- Can always borrow. On

- Government borrows

- Interest rate rises

- Business investment falls

- Aggregate demand falls

|

Finance |

Provide funds to bring expenditure on capital goods |

|

Money |

Medium of exchange used for goods/services, settle financial transactions |

|

Physical capital |

Tools, instruments machines |

|

Financial capital |

Funds that firms use to buy physical capital. |

|

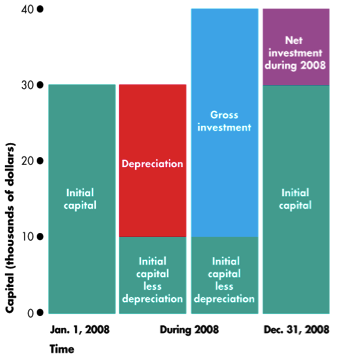

Gross investment |

Spending on purchases of new capital AND replacing depreciated capital |

|

Depreciation |

Decrease in quality from wear and tear |

|

Net investment |

|

|

Wealth |

Values of all things people own. (not income) Increases with: |

|

Saving |

Amount of income

that is not consumed (after taxes) |

*Financial markets uses savings for investment, supplied by savers and demanded by investors

Financial Markets

|

Loan Markets |

One party lends

money to another party. |

|

Bond Market |

Agreement to pay back an amount of money with interest. Bond issuer =

Borrower Used by

governments |

|

Stock market |

Share of

ownership (equity) of a company |

|

Financial institution |

Firm that operates on both sides of markets for financial capital |

|

Examples |

Banks |

|

Net worth |

|

|

Insolvency |

Negative net worth. |

|

Illiquidity |

Lack cash flow. |

![]() Market

for Loanable Funds

Market

for Loanable Funds

![]()

When one sector saves, the other one must borrow.

|

Nominal Interest Rate |

Number of dollars a borrow pays to the lender in interest in % |

|

Real Interest Rate |

|

|

Demand for Loanable Funds |

Curve between real interest rate and quantity of loanable funds demanded |

|

Determinants |

Expected profit (Direct) |

|

Supply for Loanable Funds |

Curve between real interest rate and quantity of loanable funds supplied |

|

Determinants |

Disposable income

(Direct) |

|

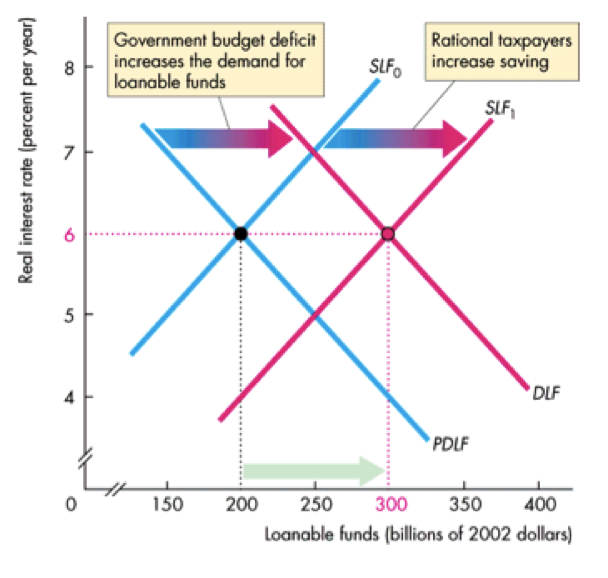

Crowding Out |

Instance where: Government borrowing will reduce private business spending through higher interest rates |

|

Ricardian Equivalence |

Financing

government spending by taxing now, or by borrowing now and taxing

alter.

|

![]() Global

Global

People seeks the highest and lowest interest rates regardless of national borders.

Capital is "mobile".

![Machine generated alternative text: I

]

red inlerest ie

7

6

5

4

7

fwodd equilibñum Net Io...n

[real_inress ending with

,‘ posl•lv. nil

/ •Kporls

/\/

o

--

9.0 9.5 10.0 10.5 11.0 11.5

Loonobi. (ends ons ol 2002 dollar.)

Nil foreign V

borrowing

3 WdlnigO*Ni .

¡ 1m” .x Equ4llbriumcpionldy

ol loonobi. lends

L,,

0 1.0 1.5 2.0 2.5 3.0 3.5

Leone b). (ends billon. el 2002 dollars)

SLF

I I I

0 1.0 1.5 2.0 2,5 30 3.5

Loonobi. funds (billion. el 2002 dollars)

(a) Th. ulabal moik.t (b) An ,nt.rnot.noI b.tr.w.r (e) An int.rnoond l.nd.r](index_files/image008.png)